Charitable IRA Qualified Charitable Distribution Legislation Renewed for 2015

Congress has renewed the Charitable IRA Qualified Charitable Distribution for 2015.

The charitable IRA qualified charitable distribution (QCD), is a special provision allowing certain donors to exclude from taxable income — and count toward their required minimum distribution — certain transfers of Individual Retirement Account (IRA) assets that are made directly to public charities, including Northwest Public Broadcasting through the WSU Foundation.

Donors age 70-1/2 or older can use this popular option to support charities with tax-wise gifts of up to $100,000. Qualified charitable distributions can count toward your minimum required distribution.

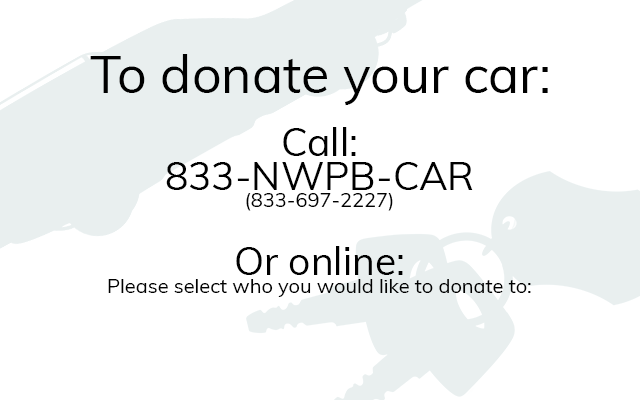

When you talk to your financial advisor or IRA agency to request a qualified charitable distribution, the following information may be helpful. Charitable contributions to Northwest Public Broadcasting are directed to

Washington State University Foundation

PO Box 641925

Pullman, WA 99164-1925

Phone: 509-335-6686 or 800-GIV-2-WSU (448-2978)

Fax: 509-335-4788

IRS Tax ID: 91-1075542

Established 1979

To ensure quick processing of your IRA contribution, simply give Northwest Public Broadcasting and/or the WSU Foundation a note or call indicating that your Charitable IRA Qualified Charitable Distribution is to be used for Northwest Public Broadcasting.

For more information, contact

Sandi Billings | Major Gifts Officer | Northwest Public Broadcasting

The Edward R. Murrow College of Communication at Washington State University

PO Box 642530 | Pullman, Washington 99164-2530

office: 509-335-3600 | cell: 208-310-9150

sandi.billings@wsu.edu | nwpb.org